The City of Oxnard would like to welcome you and thank you for choosing Oxnard to open your business. The City would like to make the process of starting a new business or relocating your existing business as easy as possible. We are here to help you and your business thrive.

Which City Department Should I Go To?

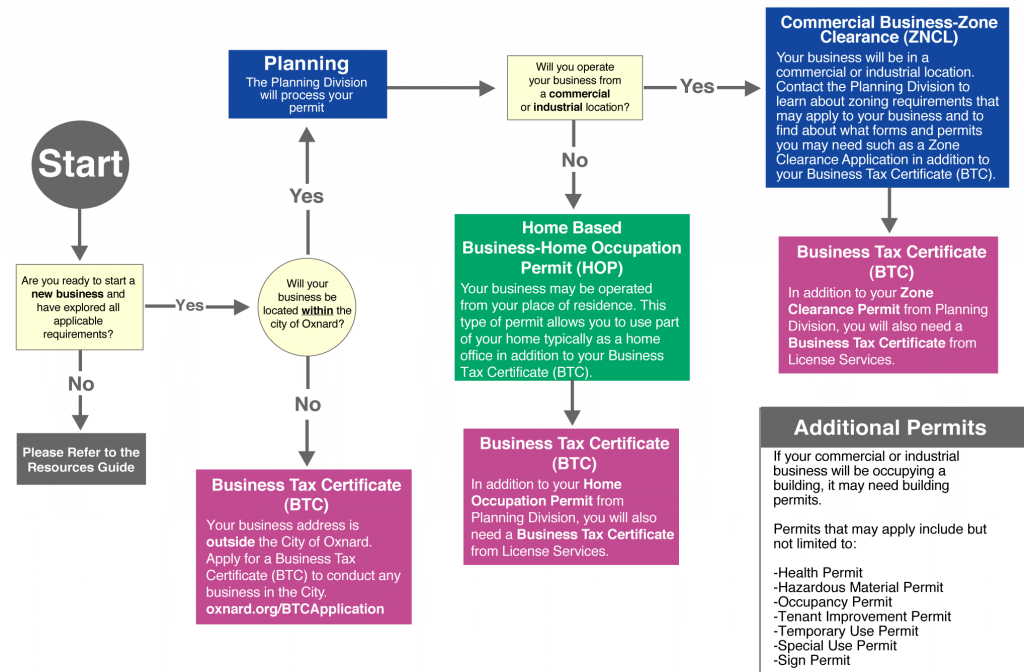

License Services will assist you with the application of your Business Tax Certificate (BTC) and additional permits that may be applicable. A BTC is required before conducting any business, trade, profession, enterprise, establishment, or occupation within the City. A BTC is a certificate issued annually which gives the business the right to conduct business within the city limits. This is applicable whether the physical business address is located inside or outside the city jurisdiction and even if a tax certificate is issued from another city. For more information, contact License Services.

Planning

The Planning Division of the Community Development Department will assist with determining the proper location for your business operation. Planning staff can help you learn about the planning process and zoning requirements for establishing a commercial or home-based business. It is vital to learn whether your business activity is allowed before you sign a lease or purchase a building. Visit our Planning counter to learn what forms and permits may be required such as a Zone Clearance Application in addition to your Business Tax Certificate (BTC).

Building & Engineering

If your business will occupy a commercial or industrial building, you may need building permits and inspections prior to being able to open for business. A Certificate of Occupancy may also be required before opening. Please contact Building & Engineering for more information.

Economic Development

Economic Development staff serve as liaisons between businesses and the City. We stand ready to assist you and provide you with the resources and information you need.

Do I need a Business Tax Certificate?

If you are ready to open your business, learn more about the Business Tax Certificate process in the chart below or by visiting License Services.

Business Tax Certificates and Permits

City of Oxnard Requirements

Business Tax Certificates

Once you have determined a business plan, have all the necessary Federal, State, and County requirements, an approved location identified for your business, you will be ready to apply for an Oxnard Business Tax Certificate.

A Business Tax Certificate is required before conducting any business, trade, profession, enterprise, establishment, or occupation within the City of Oxnard. Even if your business physical address is outside the city but you are conducting business in the city, you will require a Business Tax Certificate.

Business Tax Certificates are issued on an annual basis. The business tax certificate must be renewed in advance on the first day of the anniversary month each year. The City will send a renewal notice, however, penalties are assessed for delinquent accounts, regardless of whether you receive a renewal notice or not.

Costs & Fees

The cost of a business tax certificate varies based on the type of business. Generally, a business tax is calculated either as a flat rate or based on gross receipts. If the business tax is calculated on gross receipts, you will be required to provide a 12-month estimate of gross receipts. Each year thereafter you will be required to remit proof of gross receipts to renew.

Additional Permits:

Commercial Business-Zone Clearance Application (ZNCL)

This application ties in with a Business Tax Certificate if your business will be located at a commercial or industrial location. This application essentially clears your business to operate within a specific zone. Zone Clearances will also reveal if your proposed business location will require building improvements, parking requirements, and/or building occupancy requirements.

Some businesses require additional permits if offering certain types of services. These include but are not limited to dancing, entertainment, tobacco sales, massage parlors, mobile vendors, and taxicab companies and taxi cab drivers. Please contact licensing for additional information.

Home Based Business-Home Occupation Permit (HOP)

If your business will operate out of your home such as a home office, it will require a Home Occupation Permit in addition to a Business Tax Certificate. A planner will inquire about the type of business you intend to operate and disclose any limitations or restrictions. Generally, a home office is when you intend to use a portion of your home as your business address without modifying the existing residential use of the home.

See City Code Section 16-400 Home Occupations

Exempt Activities

Some businesses are exempt from paying a business tax but must still submit an application for a business tax certificate. If you collect retirement benefits, are a non-profit organization, have a valid Public Utilities Commission (PUC) Permit or Motor Carrier Permit (MCP), please contact Licensing Services to discuss whether you qualify for an exemption.

Business Location

Before committing to a location, be sure that the location is appropriate for your type of business. If you will be conducting business from a commercial, industrial, or home location, you will need to contact the Planning Division first to verify that your business meets the guidelines set per city zoning code. A planner will review your business plan and discuss your best options. If the location of your business is appropriate for the zone, you can then apply for a Zone Clearance or Home Occupation Application. For building permit assistance, please visit the Small Business Assistance Program.

Additional Permits

If your proposed business will store hazardous materials, the fire department will require a Certified Unified Program Agency (CUPA) permit. If your business will discharge waste water such as from auto car wash or repair, restaurants, etc. Your application will be reviewed by Water Resources Division (Source Control).

Grand Openings/Temporary Use Permits (TUP)

To help advertise most commercial businesses, you may want to have a grand opening. A Temporary Use Permit allows you to advertise a grand opening for 30-days. Inquire with a planner regarding a grand opening event.

Signs

A separate sign permit is required if your business will be installing, modifying, or replacing a sign.